Preliminary Proxy Statement | ||||||||

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||||||

Definitive Proxy Statement | ||||||||

Definitive Additional Materials | ||||||||

Soliciting Material under §240.14a-12 | ||||||||

No fee required. | ||||||||||||||

Fee paid previously with preliminary materials. | ||||||||||||||

| ☐ | Fee computed on table | |||||||||||||

Notice of 2016 Annual Meeting and Proxy Statement

_______] Stockholders: to which a nominee was or is to be selected as a director or nominee. The Board evaluates the independence of our directors annually and will review the independence of individual directors on an interim basis, as needed, to consider changes in employment, relationships and other factors. The Board parties communications received by the Corporate Secretary will be provided to the full Board or the appropriate Annual Meeting of Stockholders Attendance Information Regarding the Board and its Committees The following function standards Proxy Statement exposures anti-corruption compliance Board the Company Directors who have not achieved their applicable Ownership Threshold are required to retain future acquired shares until the Ownership Threshold is met, subject to certain limited exceptions. As of December 31, Code of Ethics and Code of Conduct We have adopted an Insider Trading Policy applicable to our directors, executive officers and Independent Registered Public Accounting Firm Audit fees1 Audit-related fees2 Tax fees3 All other fees Total pre-approved all such services in This proposal gives our stockholders the opportunity to express their views on the overall compensation of our ” Stockholders since 2011. stockholders. However, the Board and the Compensation Committee will consider the voting results, as appropriate, when adopting a policy on the frequency of future say-on-pay votes. Kathleen A. Waters, May 2013. Mr. Ackerman is also a member of the Board of One Acre Fund, a not-for-profit organization that focuses on smallholder agriculture, serving more than 3,000,000 subsistence farmers in Africa. Touche. As previously disclosed, Mr. Winstel has decided to step down as the Company's CAO, with an expected transition period to end no later than September 5, 2023. 2018, he served as our Urban Peak, a Denver non-profit that serves youth experiencing homelessness. Long-Term Incentive Program Severance and Change of Control Arrangements Policy Regarding Clawback of Bonuses and Incentive Compensation Michael D. Staffieri program. Even so, we continue to evaluate our program program to help drive above-market results and Name Kent J. Thiry Javier J. Rodriguez Michael D. Staffieri Dennis L. Kogod James K. Hilger manner, and other compliance-related factors as appropriate. In addition, the Chair of the Compensation Committee works closely with the legal, people services and finance teams between Compensation Committee meetings as needed to refine the detailed criteria and terms and conditions for the STI Program and the LTI Program, for further consideration and ultimate approval by the Compensation Committee, and in the case of the CEO, ratification by the independent directors. Notwithstanding the foregoing, neither the CEO nor any NEO is present during the Board and Compensation Committee discussions of his or her own pay. Name Kent J. Thiry Javier J. Rodriguez Michael D. Staffieri Dennis L. Kogod James K. Hilger 2022 Name Kent J. Thiry Javier J. Rodriguez Michael D. Staffieri Dennis L. Kogod Long-Term Incentive Program 2022 PSU Performance Metrics 2015 PSU Performance Metrics Kidney Care Quality Incentive Program Kidney Care Non Acquired Growth HCP New Market Success HCP New Market Adjusted Operating Income DaVita Rx Specialty Drugs Contracts Paladina Members Village Health Hospital Admission Rate Relative TSR the PSUs for the NEOs from 50% to 60% of their LTI Program opportunity. Relative TSR has been a component of the LTI Program since 2014. In Program 2015 Long-term Kent J. Thiry Javier J. Rodriguez Michael D. Staffieri Dennis L. Kogod James K. Hilger execution against the Company's public policy objectives. The Compensation Committee structured this award as a one-time cash award to deliver an incentive beyond the customized individual objectives under the STI Program, which accounted for 9% of her overall STI Program target opportunity and which did not include customized objectives relating to evolving public policy goals of the Company. Company1 Abbott Laboratories4 Aetna4 Anthem4 Baxter International4 Centene Corp. Community Health Systems, Inc. HCA Holdings, Inc. Laboratory Corporation of America Holdings Molina Healthcare, Inc. Quest Diagnostics Incorporated Tenet Healthcare, Inc. Thermo Fisher Scientific4 Universal Health Services, Inc. WellCare Health Plans4 Summary Statistics: 75th Percentile 50th Percentile 25th Percentile DaVita DaVita Percentage Rank The Compensation Committee, with the assistance of Compensia, with respect to our executive compensation policies and practices, and Willis Towers Watson, with respect to the non-executive compensation policies and practices, conducted Name Kent J. Thiry Javier J. Rodriguez Michael D. Staffieri Dennis L. Kogod James K. Hilger Dr. Garry E. Menzel Name Kent J. Thiry Javier J. Rodriguez Michael D. Staffieri Dennis L. Kogod James K. Hilger Dr. Garry E. Menzel Name Kent J. Thiry Javier J. Rodriguez Michael D. Staffieri Dennis L. Kogod7 James K. Hilger The following table sets forth information concerning outstanding SSARs and unvested stock awards held by each of the NEOs The following table sets forth information concerning the exercise of Name Kent J. Thiry Javier J. Rodriguez Michael D. Staffieri Dennis L. Kogod James K. Hilger Dr. Garry E. Menzel Name Kent J. Thiry Javier J. Rodriguez Michael D. Staffieri Dennis L. Kogod James K. Hilger Benefits commencing in the second year following the year to which the deferral election applies, after separation from service, or on any other scheduled payment date, and participants can elect to receive either a lump sum distribution or annual installments over any period from two to twenty years; provided, that, if the Deferred Compensation Plan balance does not exceed $20,000, a lump sum will be paid. If the participant has not elected a specified year for payout and the participant has a separation from service, distributions generally will be paid in a lump sum cash distribution after separation from service. Kent J. Thiry Death Disability Involuntary Termination without Cause Involuntary Termination without Cause (prior to age 62)7 Resignation for Good Reason Javier J. Rodriguez Death Disability Involuntary Termination for Other than Material Cause Resignation for Good Cause Resignation Following a Good Cause Event after a Change of Control Michael D. Staffieri Death Disability Involuntary Termination for Other than Material Cause Good Cause Resignation after a Change of Control Dennis L. Kogod Death Disability Involuntary Termination for Other than Material Cause Resignation Following a Good Cause Event Unrelated to a Change of Control Resignation Following a Good Cause Event after a Change of Control James K. Hilger Death Disability Involuntary Termination for Other than Material Cause Good Cause Resignation after a Change of Control Dr. Garry E. Menzel Involuntary Termination for Other than Material Cause In the event of termination as a result of death, the estates of the NEOs (ii) paid in full, whichever produces the better net after-tax position to the executive. Change of Control become immediately exercisable in their entirety, with such vesting to be effective as of immediately prior to the effective date of the The table below sets forth the value of the Name Kent J. Thiry3,4 Javier J. Rodriguez Michael D. Staffieri Dennis L. Kogod James K. Hilger Garry E. Menzel Name Pamela M. Arway Charles G. Berg Carol Anthony ("John") Davidson Barbara J. Desoer Paul J. Diaz Peter T. Grauer John M. Nehra Dr. William L. Roper Roger J. Valine applicable calendar quarter. Committee Chairs Retainer.Under the Director Compensation Policy, the chairs of the Audit, Compensation and Compliance and Quality Committees basis at a rate that is reasonable and fair to the Company as determined at the discretion of the We or one of our subsidiaries may occasionally enter into transactions with certain The Audit Committee of the Board of Directors (the "Audit Committee") is responsible for providing independent, objective oversight of the Board of Directors. If you wish to present a proposal for action at the 30 days before or more than 70 days after the one-year anniversary of our The Board does not know of any other matters to be presented at the exhibits, can be obtained without charge by contacting Investor Relations at the following address: Attn: Investor Relations, DaVita www.davita.com. 29, 2016![]()

May 13, 2023

Notice of 2023 Annual Meeting and Proxy Statement

], 2016Stockholder:invite yoube included in the Dow Jones Sustainability World Indices for the fifth year in a row in recognition of our corporate responsibility initiatives and performance in regards to attendESG practices. For the past 15 years we have published an annual social responsibility report we call Community Care, highlighting DaVita’s and our teammates’ contributions and support of the communities in which we live and operate.HealthCare Partners Inc. annual meetingGiving Foundation supported the Food is Medicine Coalition with a grant to provide medically tailored meals to end-stage kidney disease patients. The annual meetingMonday,Tuesday, June 20, 2016,6, 2023, at 5:30 p.m.,10:00 AM Mountain Time at DaVita HealthCare Partners Inc., 2000 16th Street, Denver, Colorado 80202.. The attached Notice of Annual Meeting and Proxy Statement will serve as your guide to the business to be conducted at the Annual Meeting and provide details on attending the virtual meeting.Among other items,Javier J. Rodriguez Pamela M. Arway Director and Chief Executive Officer Chair of the Board includestitled “General Information — Forward-Looking Statements” below for more information about the qualifications of our director nominees and the compensation of our executive officers that is relevant to matters that will be presented at the annual meeting. During the meeting, we will also report to you on the Company and provide an opportunity for stockholders to engage in a dialogue with management.We hope that you will participate in the annual meeting, either by attending and voting in person or voting by other available methods as promptly as possible. Voting by anyregarding these forward-looking statements.Notice of 2023 Annual Meeting of Stockholders available methods will ensure that you are represented at the annual meeting, even if you are not present. You may vote your proxy via the Internet, by telephone, or by mail. Please follow the instructions on the NoticeStockholders (the "Annual Meeting") of Internet Availability of Proxy Materials that you receive in the mail and/or your proxy card.Your vote is very important to us and to our business. Please take the first opportunity to ensure that your shares are represented at the annual meeting.Thank you very much for your continued interest in our business.Sincerely,

Kent J. ThiryChairman of the Board,Chief Executive Officer

DaVita HealthCare Partners Inc., andChief Executive Officer, HealthCare Partners Notice of 2016 Annual Meeting of StockholdersMonday, June 20, 20165:30 p.m., Mountain TimeDaVita HealthCare Partners Inc.2000 16th StreetDenver, Colorado 80202The 2016 annual meeting of the stockholders of DaVita HealthCare Partners Inc., a Delaware corporation, will be a virtual-only meeting to be held as a Monday,Tuesday, June 20, 20166, 2023 at 5:30 p.m.,10:00 AM Mountain Time, at DaVita HealthCare Partners Inc., 2000 16th Street, Denver, Colorado 80202, forTime.purposes, whichmatters at the DaVita Inc. (the "Company" or "DaVita")2023 Annual Meeting of Stockholders (the "Annual Meeting"):Items of Business Board Recommendation Where to Find More Information in the Proxy Statement To vote upon the election of the nine director nominees, identified in the accompanying Proxy Statement, to the Board of Directors, each to serve until the Company's 2024 Annual Meeting of Stockholders or until their successors are duly elected and qualified; "FOR" all nominees Pages [__] To ratify the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2023; "FOR" Page [__] To approve, on an advisory basis, the compensation of our named executive officers; "FOR" Page [__] To approve, on an advisory basis, the frequency of future advisory votes on named executive officer compensation; and "1 YEAR" Page [__] To approve an amendment and restatement of the Company’s Restated Certificate of Incorporation to provide for the exculpation of officers as permitted by Delaware law. "FOR" Pages [__] further describedset out in the accompanying Proxy Statement:•To vote uponStatement under the electionheading "How to Vote."director nominees identified indays prior to the attachedAnnual Meeting, you may contact Investor Relations at 1-888-484-7505 to request the list of stockholders entitled to vote at the Annual Meeting.toand Annual Report are available atwww.proxyvote.com.Samantha A. Caldwell Corporate Secretary Table of Contents Insider Trading Policy Table of Contents Corporate Governance 2017 annual meetingCompany's 2024 Annual Meeting of stockholders of the CompanyStockholders (the "2024 Annual Meeting") or until their successors are duly elected and qualified;•To ratifyqualified, subject to such director’s earlier death, resignation, disqualification or removal.appointmentmajority of KPMG LLP as our independent registered public accounting firm for fiscal year 2016;•To hold an advisory vote to approve executive compensation;•To adopt and approve proposed amendments to our Amended and Restated Bylaws to adopt proxy access;•To adopt and approve an amendment to increasevotes cast by the numberholders of shares available under our Employee Stock Purchase Plan by 7,500,000 shares;•To consider and vote upon a stockholder proposal regarding action by written consent, if properly presented at the annual meeting; and•To transact such other business as may properly come before the annual meeting or any adjournment thereof.We will mail, on or about May [ ], 2016, a Notice of Internet Availability of Proxy Materials to stockholders of record and beneficial owners as of the close of business on April 22, 2016. On the date of mailing of the Notice of Internet Availability of Proxy Materials, the proxy materials will be accessible on a website referred to in the Notice of Internet Availability of Proxy Materials. These proxy materials will be available free of charge.The Notice of Internet Availability of Proxy Materials will also identify the date, time, and location of the annual meeting; the matters to be acted upon at the annual meeting and the Board of Directors' recommendation with regard to each matter; a toll-free telephone number, an e-mail address, and a website where stockholders can request a paper or e-mail copy of the Proxy Statement, our Annual Report to Stockholders, and a form of proxy relating to the annual meeting; information on how to access the form of proxy over the Internet and how to vote over the Internet; and information on how to obtain directions to attend the annual meeting and vote in person. If you attend the annual meeting and previously used the telephone or Internet voting systems, or mailed your completed proxy card, you may vote in person at the meeting if you wish to change your vote in any way.Please note that all votes cast via telephone or the Internet must be cast prior to 11:59 p.m., Eastern Time, on Sunday, June 19, 2016.By order of the Board of Directors,![]()

Martha HaCorporate SecretaryDaVita HealthCare Partners Inc.May [ ], 2016Proxy Statement 1General Information1Voting Information2Votes Required for Proposals2Proxy Solicitation Costs2Delivery of Proxy Statement and Annual Report3Admission to Annual Meeting3Electronic Availability of Proxy Materials for the 2016 Annual Meeting4Proposal 1 Election of Directors5Information Concerning Members of the Board Standing for Election6Corporate Governance10Selection of Directors10Director Independence10Leadership Structure and Meetings of Independent Directors11Communications with the Board12Annual Meeting of Stockholders12Information Regarding the Board and its Committees12Committees of the Board13Overview of Committee Membership Qualifications15Risk Oversight15Board Share Ownership Policy15Code of Ethics and Codes of Conduct16Insider Trading Policy16Proposal 2 Ratification of Appointment of Independent Registered Public Accounting Firm17Pre-approval Policies and Procedures17Proposal 3 Advisory Vote on Executive Compensation18Proposal 4 Stockholder Approval of Proposed Amendments to our Amended and Related Bylaws to Adopt Proxy Access20Proposal 5 Amendment to Increase the Number of Shares Available Under our Employee Stock Purchase Plan by 7,500,000 Shares24Proposal 6 Stockholder Proposal Regarding Action by Written Consent28Security Ownership of Certain Beneficial Owners and Management30Information Concerning Our Executive Officers32Section 16(a) Beneficial Ownership Reporting Compliance33Compensation Discussion and Analysis34Table of Contents34Compensation Discussion and Analysis Information35Compensation Committee Report53Executive Compensation542015 Summary Compensation Table542015 Grants of Plan-Based Awards562015 Outstanding Equity Awards at Fiscal Year-End572015 Option Exercises and Stock Vested59No Pension Benefits59Nonqualified Deferred Compensation592015 Nonqualified Deferred Compensation59Voluntary Deferral Plan and Deferred Compensation Plan60Executive Retirement Plan60Potential Payments Upon Termination or Change of Control61Compensation of Directors67Compensation Committee Interlocks and Insider Participation70Certain Relationships and Related Transactions71Audit Committee Report72Stockholder Proposals for 2017 Annual Meeting73Other Matters74DaVita HealthCare Partners Inc. Notice of 2016 Annual Meeting and Proxy Statement Proxy StatementWe are delivering this Proxy Statement in connection with the solicitation of proxies by our Board of Directors (the "Board"), for use at our 2016 annual meeting of stockholders, which we will hold on Monday, June 20, 2016 at 5:30 p.m., Mountain Time, at DaVita HealthCare Partners Inc. (the "Company"), 2000 16th Street, Denver, Colorado 80202. The proxies will remain valid for use at any meetings held upon adjournment of that meeting. The record date for the annual meeting is the close of business on April 22, 2016. All holders of record of our common stock on the record date are entitled to notice of the annual meeting and to vote at the annual meeting and any meetings held upon adjournment of that meeting. Our principal executive offices are located at 2000 16th Street, Denver, Colorado, 80202, and our telephone number is (303) 405-2100. To obtain directions to our annual meeting, visit our website, located athttp://www.davita.com.In accordance with rules and regulations adopted by the Securities and Exchange Commission (the "SEC"), instead of mailing a printed copy of our proxy materials to each stockholder of record or beneficial owner, we are furnishing the proxy materials to our stockholders over the Internet, which include this Proxy Statement and the accompanying Notice of Meeting, Proxy Card, and Annual Report to Stockholders. Because you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials, unless you have previously made a permanent election to receive these materials in paper copy. Instead, the Notice of Internet Availability of Proxy Materials instructs you as to how you may access and review all of the important information contained in the proxy materials, and how you may submit your vote by proxy on the Internet. If you received a Notice of Internet Availability of Proxy Materials by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability of Proxy Materials. The Notice of Internet Availability of Proxy Materials will be first mailed on or about May [ ], 2016 to all stockholders of record as of April 22, 2016.Whether or not you plan to attend the annual meeting in person, please vote by telephone, Internet, or request aProxy Card to complete, sign, date and return by mail to ensure that your shares will be voted at the annual meeting. You may revoke your proxy at any time prior to its use by filing with our secretary an instrument revoking it or a duly executed proxy bearing a later date or by attending the annual meeting and voting in person.If you plan to attend the annual meeting in person, please so indicate when you submit your proxy by mail, by telephone or via the Internet and bring with you the items that are required pursuant to the Company's admission process for the 2016 Annual Meeting. A description of the admission process can be found below in this Proxy Statement under the heading "General Information — Admission to Annual Meeting."Unless you instruct otherwise in the proxy, any proxy that is given and not revoked will be voted at the annual meeting:•For the election of the ten director nominees identified in this proxy statement to serve until the 2017 annual meeting of stockholders of the Company or until their successors are duly elected and qualified;•For the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2016;•For the approval, on an advisory basis, of executive compensation;•For the adoption and approval of the proposed amendments to our Amended and Restated Bylaws to adopt proxy access;•For the adoption and approval of an amendment to increase the number of shares available under our Employee Stock Purchase Plan by 7,500,000 shares;•Against the stockholder proposal regarding action by written consent, if properly presented at the annual meeting; and•As determined by the proxy holders named in the Proxy Card in their discretion, with regard to all other matters as may properly come before the annual meeting or any adjournment thereof.Continues on next page ►DaVita HealthCare Partners Inc. Notice of 2016 Annual Meeting and Proxy Statement 1Voting InformationOur only voting securities are the outstanding shares of our common stock. At the record date, we had approximately 206,518,830 shares of common stock outstanding. Each stockholder is entitled to one vote per share on each matter that we will consider at this meeting. Stockholders are not entitled to cumulate votes. Under the rules of the New York Stock Exchange, your bank, broker, or other nominee may not vote your uninstructed shares in the election of directors and certain other matters on a discretionary basis. Accordingly, brokers holding shares of record for their customers generally are not entitled to vote on these matters unless their customers give them specific voting instructions. If the broker does not receive specific instructions, the broker will note this on the proxy form or otherwise advise us that it lacks voting authority. Thus, if you hold your shares in "street name," meaning that your shares are registered in the name of your bank,broker, or other nominee, and you do not instruct your bank, broker, or other nominee how to vote, no votes will be cast on your behalf on any proposal other than the proposal for the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2016. The votes that the brokers would have cast if their customers had given them specific instructions are commonly called "broker non-votes." If the stockholders of record present in personvirtually or represented by their proxiesproxy and entitled to vote at the annual meeting hold at leastthereon. In a majority of our shares of common stock outstanding as of the record date, a quorum will exist for the transaction of business at the annual meeting. Stockholders attending the annual meeting in person or represented by proxy at the annual meeting who abstain from voting and broker non-votescontested election, directors are counted as present for quorum purposes.Votes Required for ProposalsDirectors are elected by a majority of votes cast, which means that the number of shares voted "for" each of the ten nominees for election to the Board must exceed 50% of the number of votes cast with respect to each nominee's election. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the election of directors. In the event that the number of nominees exceeds the number of directors to be elected, which is a situation that we do not anticipate, directors will be elected by a plurality of the shares represented in personvirtually or by proxy at any such meeting and entitled to vote on the election of directors.The ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2016, the approval of the proposal regarding the advisory vote on executive compensation, the approval of the proxy amendments to our Bylaws, the approval of the amendment to our Employee Stock Purchase Plan, and the stockholder proposal, if properly brought beforethe annual meeting, each require the affirmative vote of a majority of the shares of common stock present at the annual meeting in person or by proxy and entitled to vote thereon. Because your vote on executive compensation and the stockholder proposal is advisory, the results of those votes will not be binding on the Company or the Board. However, the Board and any applicable Board committee will consider the voting results as appropriate when making future decisions regarding executive compensation and matters related to the subject of the stockholder proposal. Abstentions are considered present and entitled to vote with respect to each of these proposals and will, therefore, have the same effect as votes against these proposals. Except for the proposal to ratify the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2016, broker non-votes will not be considered as present and entitled to vote on these proposals, and will therefore have no effect on the number of affirmative votes needed to approve these proposals.Proxy Solicitation CostsWe will pay for the cost of preparing, assembling, printing and mailing of the Notice of Internet Availability of Proxy Materials, this Proxy Statement and the accompanying Notice of Meeting, Proxy Card, and Annual Report to Stockholders to our stockholders, as well as the cost of our solicitation of proxies relating tothe annual meeting. We may request banks and brokers to solicit their customers who beneficially own our common stock listed of record in names of nominees. We will reimburse these banks and brokers for their reasonable out-of-pocket expenses regarding these solicitations. We have also retained MacKenzie2Proxy StatementPartners, Inc. ("MacKenzie") to assist in the distribution and solicitation of proxies and to verify records related to the solicitation at a fee of $15,000 plus reimbursement for all reasonable out-of-pocket expenses incurred during the solicitation. MacKenzie and our officers, directors and employees may supplement the original solicitation by mail of proxies, by telephone,facsimile, e-mail and personal solicitation. We will pay no additional compensation to our officers, directors and employees for these activities. We have agreed to indemnify MacKenzie against liabilities and expenses arising in connection with the proxy solicitation unless caused by MacKenzie's negligence or intentional misconduct.Delivery of Proxy Statement and Annual ReportBeneficial owners, but not record holders, of our common stock who share a single address may receive only one copy of the Notice of Internet Availability of Proxy Materials and, as applicable, an Annual Report to Stockholders and Proxy Statement, unless their broker has received contrary instructions from any beneficial owner at that address. This practice, known as "householding," is designed to reduce printing and mailing costs. If any beneficial owner at such an address wishes to discontinue householding and receive a separate copy of the Notice of Internet Availability of Proxy Materials and, if applicable, an Annual Report to Stockholders and Proxy Statement, they should notify their broker. Beneficial owners sharing an address to which a single copy of the Notice of Internet Availabilityof Proxy Materials and, if applicable, an Annual Report to Stockholders and Proxy Statement was delivered can also request prompt delivery of a separate copy of the Notice of Internet Availability of Proxy Materials and, if applicable, an Annual Report to Stockholders and Proxy Statement by contacting Investor Relations at the following address or phone number: Attn: Investor Relations, DaVita HealthCare Partners Inc., 2000 16th Street, Denver, Colorado 80202, (888) 484-7505. Additionally, stockholders who share the same address and receive multiple copies of the Notice of Internet Availability of Proxy Materials and, if applicable, an Annual Report to Stockholders and Proxy Statement, can request a single copy by contacting us at the address or phone number above.Admission to Annual MeetingAdmission to the annual meeting will be limited to holders of the Company's common stock, family members accompanying holders of the Company's common stock, persons holding executed proxies from stockholders who held the Company's common stock as of the close of business on April 22, 2016 and such other persons as the chair of the annual meeting shall determine.If you are a holder of the Company's common stock, you must bring certain documents with you in order to be admitted to the annual meeting and in order to bring family members with you. The purpose of this requirement is to help us verify that you are actually a holder of the Company's common stock. Please read the following procedures carefully, because they specify the documents that you must bring with you to the annual meeting in order to be admitted. The items that you must bring with you differ depending upon whether or not you were a record holder of the Company's common stock as of the close of business on April 22, 2016. A "record holder" of stock is someone whose shares of stock are registered in his or her name in the records of the Company's transfer agent. Many stockholders are not record holders because their shares of stock are held in "street name," meaning that the shares are registered in the name of their broker, bank or other nominee, and the broker, bank or other nominee is the record holderinstead. If you are unsure as to whether you were a record holder of the Company's common stock as of the close of business on April 22, 2016, please call the Company's transfer agent, Computershare, at (877) 889-2012.If you were a record holder of the Company's common stock as of the close of business on April 22, 2016, then you must bring a valid personal photo identification (such as a driver's license or passport).At the annual meeting, we will check your name for verification purposes against our list of record holders as of the close of business on April 22, 2016.If a broker, bank or other nominee was the record holder of your shares of the Company's common stock as of the close of business on April 22, 2016, then you must bring:•valid personal photo identification (such as a driver's license or passport); and•proof that you owned shares of the Company's common stock as of the close of business on April 22, 2016.Continues on next page ►DaVita HealthCare Partners Inc. Notice of 2016 Annual Meeting and Proxy Statement 3Examples of proof of ownership include the following: (i) an original or a copy of the voting instruction from your bank or broker with your name on it, (ii) a letter from your bank or broker stating that you owned the Company's common stock as of the close of business on April 22, 2016, or (iii) a brokerage account statement indicating that you owned the Company's common stock as of the close of business on April 22, 2016.If you acquired your shares of the Company's common stock at any time after the close of business on April 22, 2016, you do not have the right to vote at the annual meeting, but you may attend the meeting if you bring with you:•valid personal photo identification (such as a driver's license or passport); and•proof that you own shares of the Company's common stock.Examples of proof of ownership include the following:•if a broker, bank or other nominee is the record holder of your shares of the Company's common stock: (i) a letter from your bank or broker stating that you acquired the Company's common stock after April 22, 2016, or (ii) a brokerage account statement as of a date after April 22, 2016 indicating that you own the Company's common stock; or•if you are the record holder of your shares of the Company's common stock, a copy of your stock certificate or a confirmation acceptable to the Company that you bought the stock after April 22, 2016.If you are a proxy holder for a stockholder of the Company who owned shares of the Company's common stock as of the close of business on April 22, 2016, then you must bring:•the executed proxy naming you as the proxy holder, signed by a stockholder of the Company who owned shares of the Company's common stock as of the close of business on April 22, 2016;•valid personal photo identification (such as a driver's license or passport); and•if the stockholder whose proxy you hold was not a record holder of the Company's common stock as of the close of business on April 22, 2016, proof of the stockholder's ownership of shares of the Company's common stock as of the close of business on April 22, 2016, in the form of (i) an original or a copy of the voting instruction form from the stockholder's bank or broker with the stockholder's name on it, or (ii) a letter or statement from a bank, broker or other nominee indicating that the stockholder owned the Company's common stock as of the close of business on April 22, 2016.No cameras, recording equipment, electronic devices, large bags, briefcases or packages will be permitted at the annual meeting. Shares may be voted in person at the annual meeting only by (a) the record holder as of the close of business on April 22, 2016 or (b) a person holding a valid proxy executed by such record holder.Electronic Availability of Proxy Materials for the 2016 Annual MeetingImportant Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on June 20, 2016. This Proxy Statement and the AnnualReport to Stockholders and Form 10-K for fiscal year 2015 are available electronically atwww.proxyvote.com.4Proxy StatementProposal 1 Election of DirectorsAt the annual meeting, you will elect ten directors to serve until the 2017 annual meeting of stockholders or until their respective successors are elected and qualified, subject to such director's earlier death, resignation, disqualification or removal.Our bylaws require that each director be elected by the majority of votes cast with respect to such director in uncontested elections. In a contested election, where the number of nominees for director exceeds the number of directors to be elected, directors are elected by a plurality of shares represented in person or by proxy at any such meeting and entitled to vote on the election of directors. If a nominee for director who was in officeserved as a director prior to the electionAnnual Meeting is not elected by a majority of votes cast,the requisite vote, the director must promptly tender his or her resignation from the Board, and the Nominating and Governance Committee of the Board will make a recommendation to the Board about whether to accept or reject the resignation, or whether to take other action.resignation. The Board, excluding the director in question, will act on the recommendation of the Nominating and Governance Committee and publicly disclose its decision and its rationale within 90 days (or, if so extended by the Board in certain circumstances, within 180 days) from the date the election results are certified. If a nominee for director who was not already serving as a director does not receive a majority of votes cast in an uncontested electionthe requisite vote at the annual meeting,Annual Meeting, the nominee is not elected to the Board. All 20162023 director nominees are currently serving on the Board.After a thorough evaluation and assessment, the Nominating and Governance Committee has recommended, and the Board has re-nominated, Pamela M. Arway, Charles G. Berg, Carol Anthony ("John") Davidson, Barbara J. Desoer, Paul J. Diaz, Peter T. Grauer, John M. Nehra, William L. Roper, Kent J. Thiry and Roger J. Valine for election as directors. Please see the section titled "Corporate Governance — Selection of Directors" below for more information about the re-nomination process.Nine Eight of the tennine director nominees for director have been determined to beare independent under the listing standards of the New York Stock Exchange ("NYSE") listing standards (the "NYSE Independence Standards"). Please see the section titled "Corporate“Corporate Governance — Director Independence"Independence” below for more information. Each director nominee has consented to being named as a nominee in this Proxy Statement as a nominee and has agreed to serve as a director, if elected.indicates otherwise, the personsholders named as proxies in the accompanying proxy card (the “Company Proxies”) have advised us that at the annual meetingAnnual Meeting they intend to vote the shares covered by the proxies for"for" the election of each of the director nominees named above.in this Proxy Statement. If one or more of the nominees areany director nominee is unable or not willingunwilling to serve, the persons named as proxiesCompany Proxies may vote for the election of the substitute nomineesnominee that the Board may propose. The accompanying proxy contains a discretionary grant of authority with respect to this matter. The persons named as proxiesProxies may not votebe voted for a greater number of personsmore than the number of nominees named above.nine director nominees.Continues on next page ►DaVita HealthCare Partners Inc. Notice of 2016 Annual Meeting and Proxy Statement 5

Biographies of our Director NomineesInformation Concerning Members of the Board Standing for Election current as of March 31, 2016,[_______], 2023, setting forth his or her age, and describing his or her business experience during the past five years, including other prior relevant business experience, is presented below.

62, has been one of our directors since May 2009. From 2005 to 2007, Ms. Arway69, served as the presidentPresident of the Japan, Asia-Pacific, Australia region for American Express International, Japan, Asia-Pacific, Australia region,Inc., a global payment services and travel company.company, from 2005 to 2008. Ms. Arway joined the American Express Company in 1987, after which sheand subsequently served in various capacities, including as chief executive officerChief Executive Officer ("CEO") of American Express Australia Limited from 2004 to 2005 and as executive vice presidentExecutive Vice President of Corporate Travel, North America from 2000 to 2004. Prior to her retirement in October 2008, she also served as advisor to the American Express Company's chairmanCompany’s Chairman and chief executive officer.CEO. Since May 2010, Ms. Arway has also been a member of the boardBoard of theDirectors of The Hershey Company, a chocolate and confectionaryconfectionery company, and since May 2010. She currently serves as the Chair of the Governance Committee and asMarch 2014, Ms. Arway has been a member of the Audit and Executive CommitteesBoard of Hershey Company's board. She joined the boardDirectors of Iron Mountain Incorporated, an enterprise information management services company, in March 2014 and serves as chair of its Compensation Committee.company. Ms. Arway brings significant leadership experience as a global executive, with extensive management experience in the areas of marketing, international business, finance and government affairs. With her service as a director on the boards of other large public companies, Ms. Arway also brings significant experience in corporate governance and executive compensation-related matters.

58,65, has been oneserved as a Senior Advisor for The Cigna Group (“Cigna”), a global health service company, since January 2023, and served as President of our directors since March 2007.U.S. Government Business and Senior Advisor for Cigna from January 2022 to January 2023. Mr. Berg served as executive chairman andExecutive Chair of DaVita Medical Group ("DMG"), DaVita's former integrated healthcare business, from November 2016 until December 2017. From 2008 to 2013, Mr. Berg served as a member of the board of directorsExecutive Chair of WellCare Health Plans, Inc. ("WellCare"(“WellCare”), a provider of managed care services for government-sponsored healthcare programs from January 2008 to December 2010.programs. Mr. Berg served as non-executive chairmanNon-Executive Chair of the boardBoard of directorsDirectors of WellCare from January 2011 until his retirement in May 2013. From January 2007 to April 2009, Mr. Berg was a senior advisorSenior Advisor to Welsh, Carson, Anderson & Stowe, a private equity firm. From April 1998 to July 2004, Mr. Berg held various executive positions, including Executive Vice President - Medical Delivery, President and Chief Operating Officer ("COO") with Oxford Health Plans, Inc. ("Oxford"(“Oxford”), a health benefit plan provider, which included chief executive officer from November 2002 to July 2004provider. He was the CEO when Oxford was acquired by UnitedHealth Group, president and chief operating officer from March 2001 to November 2002 and executive vice president, medical delivery from April 1998 to March 2001. From July 2004 to September 2006, Mr. Berg served asGroup. He then became an executive of UnitedHealth Group and was primarily responsible for integrating the Oxford business. Mr. Berg also currently serves onas a member of the Operating Council & Senior Advisory Board of Consonance Capital Partners, a private equity firm, and the board of directors of Justworks, Inc., a private human resources and payment company.firm. Mr. Berg is an experienced business leader with significant experience in the healthcare industry and brings an understanding of the operational, financial and regulatory aspects of our industry and business.6Proxy Statement

2

Carol Anthony ("John") Davidson60, has been one of our directors since December 2010. From January 2004 until his retirement in September 2012, Mr. Davidson70, served as the senior vice president, controllerCEO and chief accounting officer of Tyco International Ltd. ("Tyco"), a provider of diversified industrial products and services. Prior to joining Tyco in January 2004, he spent six years at Dell Inc., a computer and technology services company, where he held various leadership roles, including vice president, audit, risk and compliance, and vice president, corporate controller. In addition, he previously spent 16 years at Eastman Kodak Company, a provider of imaging technology products and services, in a variety of accounting and financial leadership roles. Mr. Davidson is a director of Pentair Plc., a provider of products and solutions in water, fluids, thermal management and equipment protection, Legg Mason Inc., a global asset management firm, and TE Connectivity Ltd., a technology company that was spun off by Tyco. From 2010 to 2015, Mr. Davidson was a member of the Board of Trustees of the Financial Accounting Foundation which oversees financial accounting and reporting standards setting processes for the United States. Mr. Davidson also serves on the Board of Governors of the Financial Industry Regulatory Authority. Mr. Davidson is a CPA with more than 30 years of leadership experience across multiple industries and brings a strong track record of building and leading global teams and implementing governance and controls processes.

Barbara J. Desoer, 63, has been one of our directors since October 2015. Ms. Desoer currently serves as the chief executive officer and a member of the board of directorsDirectors of Citibank, N.A., a wholly owned subsidiary of Citigroup, Inc. and, a diversified global financial services company, sinceboth positions she held from April 2014. Ms. Desoer previously served as the chief operating officer2014 through April 2019, and COO of Citibank, N.A. from October 2013 to April 2014. In addition to her chief executive officer responsibilities, Ms. Desoer leads Citigroup's comprehensive capital analysis and review process. Prior to Citibank, N.A., Ms. Desoer spent 35 years at Bank of America, a diversified global financial services company, most recently as president,President, Bank of America Home Loans, where she led the integration of Countrywide, the largest mortgage originator and servicer in the United States. In previous Bank of America roles, Ms. Desoer wasserved as a Global Technology & Operations executive, an international market-focused position leading teams in the United Kingdom, Asia and Latin America. She alsoAmerica, and President, Consumer Products. Since April 2019, Ms. Desoer has served as president, Consumer Products.Chair of Citibank, N.A. and as a director of Citigroup, Inc. She serves on the boardAdvisory Board of visitors at the University of California at Berkeley.InStride. Ms. Desoer also has served on the board of directors of various non-profit and privately held corporations. Ms. Desoer is an experienced business leader with extensive management and international experience, and brings a deep understanding of regulated businesses.

Paul J. Diaz54, has been one of our directors since July 2007. Mr. Diaz serves as the executive vice chairman of Kindred Healthcare, Inc. ("Kindred"), a provider of long-term healthcare services in the United States, a position he has held since March 2015. Since August 2014, Mr. Diaz50, has served as the CEO and a partner at Guidon Partners LP, an investment strategy partnership. Hemember of the Board of Directors of Cardinal Health, Inc. ("Cardinal"), a global integrated healthcare services and products company, since September 2022. Prior to his appointment as CEO, Mr. Hollar served as chief executive officerChief Financial Officer for Cardinal from May 2020 to September 2022, where he led financial activities across the enterprise including financial strategy, capital deployment, treasury, tax, investor relations, accounting and reporting. Prior to Cardinal, from June 2018 until April 2020, Mr. Hollar served as Executive Vice President and Chief Financial Officer of KindredTenneco Inc. ("Tenneco"), a global automotive products and services company, where he was responsible for financial planning and analysis, accounting and reporting, tax, treasury and investor relations for the company. At Tenneco, Mr. Hollar also served as Senior Vice President, Finance from January 2004June 2017 to March 2015,June 2018. From October 2016 to June 2017, Mr. Hollar served as well as president from January 2002 to May 2012the Chief Financial Officer of Sears Holding Corporation ("Sears"), a holding company for large consumer retailers across the U.S., and as chief operating officerSenior Vice President, Finance from January 2002October 2014 to December 2003.October 2016. Sears filed for Chapter 11 bankruptcy in October 2018. Mr. Hollar is an experienced finance leader who brings to the Board more than 25 years of financial and operational experience spanning the healthcare, transportation, manufacturing and retail sectors.

joining Kindred, Mr. DiazMicrosoft, Dr. Moore served as Vice President of Google Inc. ("Google"), a multinational technology company that specializes in Internet-related products and services, from 2016 to 2019, and was the managingfounder and leader of Google Cloud Healthcare and Life Sciences globally. Dr. Moore is an engineer, practicing physician, and experienced educator. He is board certified in Diagnostic Radiology, Neuroradiology and Clinical Informatics. Prior to his leadership roles at Microsoft and Google, Dr. Moore served as the Chief Emerging Technology and Informatics Officer at Geisinger Health System, a regional healthcare provider, where he was also Director of the Institute of Advanced Application. His prior academic and clinical appointments include Stanford University School of Medicine, Penn State University College of Medicine, and Wayne State University School of Medicine. From 2019 until its merger with Baxter International Inc. in 2021, Dr. Moore was a member of Falcon Capital Partners, LLC, a private investment and consulting firm, and from 1996 to July 1998, Mr. Diaz served in various executive capacities with Mariner Health Group, Inc., a health care facility operator, including as executive vice president and chief operating officer. Mr. Diaz serves on the boardsBoard of Kindred and Patterson MedicalDirectors of Hill-Rom Holdings, Inc., a private medical supply distribution company, andtechnology provider. Dr. Moore brings to the board of visitors of Georgetown University Law Center and previously served on the board of PharMerica Corporation. Mr. Diaz is an experienced business leader with significantBoard substantial experience in the healthcare industrymedical field as a practitioner and brings an understanding ofhas a unique perspective, having also worked in the operational, financial and regulatory aspects of our industry and business.high technology sector for the last several years.Continues on next page ►DaVita HealthCare Partners Inc. Notice of 2016 Annual Meeting and Proxy Statement 7

Peter T. Grauer, 70, has been one of our directors since August 1994 and our lead independent director since 2003. Mr. Grauer has been chairman of the board of Bloomberg, Inc., a business and financial information company, since April 2001, treasurer since March 2001 and was its chief executive officer from March 2002 until July 2011. Mr. Grauer has also served as a non-executive director of Glencore plc, a global mining and commodities firm listed on the London Stock Exchange, since June 2013. From November 2000 until March 2002, Mr. Grauer was a managing director of Credit Suisse First Boston, a financial services firm. From September 1992 until November 2000, upon the merger of Donaldson, Lufkin & Jenrette ("DLJ"), a financial services firm, into Credit Suisse First Boston, Mr. Grauer was a managing director and founding partner of DLJ Merchant Banking Partners. Mr. Grauer serves as a director of Blackstone Group, L.P., a publicly traded global investment and advisory firm. Mr. Grauer has significant experience as a business leader and brings a deep understanding of our business and industry through his over 20 years of service as a member of the Board.

67, has been one of our directors since November 2000. From74, was, from 1989 until his retirement in August 2014, Mr. Nehra was affiliated with New Enterprise Associates ("NEA"(“NEA”), a venture capital firm, including, from 1993 until his retirement, as general partnerGeneral Partner of several of its affiliated venture capital limited partnerships. After his retirement in August 2014, Mr. Nehra remained a retired Special Partner with NEA and continued serving on the board of directors of a number of NEA’s portfolio companies. Mr. Nehra also served as managing general partnerManaging General Partner of Catalyst Ventures, a venture capital firm,an affiliate of NEA, from 1989 to 2013. Since 2021, Mr. Nehra has served onas a member of the boardsBoard of CVRx, Inc., a number of NEA's portfolio companies until his retirement in August 2014 and remains a retired special partner of NEA.commercial-stage medical device company. Mr. Nehra is an experienced business leader with approximately 4445 years of experience in investment banking, research and capital markets and he brings a deep understanding of our business and industry through his nearly 1523 years of service as a member of the Board as well as significant experience in the healthcare industry through his involvement with NEA'sNEA’s healthcare-related portfolio companies.

Dr. William L. Roper67,58, has been oneserved as Chairman of our directorsthe Board of Labcorp, a leading global life sciences company, since May 2001. Dr. Roper has been chief executive officer of the University of North Carolina ("UNC") Health Care System, dean of the UNC School of Medicine and vice chancellor for medical affairs of UNC since March 2004. Dr. Roper also continues to serve2020, as a professordirector of health policyLabcorp since April 2013, and administration in the UNC School of Public HealthPresident and a professor of pediatrics and of social medicine in the UNC School of Medicine. From 1997 until March 2004, he was dean of the UNC School of Public Health. Before joining UNC in 1997, Dr. RoperChief Executive Officer since November 2019. Mr. Schechter previously served as senior vice presidentspecial advisor to the CEO of Prudential Health Care. He also served as directorMerck & Co., Inc. (“Merck”), a multinational pharmaceutical company, from January 2019 to July 2019. From 2010 to 2018, Mr. Schechter was an Executive Vice President of the Centers for Disease Control and Prevention from 1990 to 1993, on the senior White House staff in 1989 and 1990 and as the administrator of Centers for Medicare & Medicaid Services from 1986 to 1989. Dr. RoperMerck, where he was a member of Merck’s executive committee, pharmaceutical and isvaccines operating committee, and President of Merck’s Global Human Health Division, which included Merck’s worldwide pharmaceutical and vaccine businesses. Prior to becoming President, Global Human Health, Mr. Schechter served as President, Global Pharmaceutical Business of Merck from 2007 to 2010. In 2022, Mr. Schechter earned the immediate past chairmanCERT Certificate in Cybersecurity Oversight. Mr. Schechter brings to the Board extensive knowledge of the boardhealthcare industry, operations and regulatory environment, significant executive leadership and management experience. In addition, his CERT Certificate in Cybersecurity Oversight strengthens this valuable expertise of the National Quality Forum, a non-profit organization that aims to improve the quality of healthcare. From December 2007 to November 2011, Dr. Roper served on the board of Medco Health Solutions, Inc., a pharmacy benefits management company, and since November 2011 has served on the board of its successor company, Express Scripts Holding Company. Dr. Roper brings substantial expertise in the medical field, an in-depth understanding of the regulatory aspects of our business as well as clinical, financial and operational experience.Board. 8Proxy Statement

4

Kent J. Thiry60,65, has been our chairman of the Board since June 2015 and from October 1999 until November 2012, and our chief executive officer since October 1999. In October 2014, Mr. Thiry also became chief executive officer of our integrated care business, HealthCare Partners ("HCP"). From November 2012 until June 2015, Mr. Thiry served as our co-chairman of the Board. From June 1997 until he joined us in October 1999, Mr. Thiry was chairman of the board and chief executive officer of Vivra Holdings, Inc., which was formed to operate the non-dialysis business of Vivra Incorporated ("Vivra") after Gambro AB acquired the dialysis services business of Vivra in June 1997. From September 1992 to June 1997, Mr. Thiry was the president and chief executive officer of Vivra, a provider of renal dialysis and other healthcare services. From April 1992 to August 1992, Mr. Thiry was president and co-chief executive officer of Vivra, and from September 1991 to March 1992, he was president and chief operating officer of Vivra. From 1983 to 1991, Mr. Thiry was associatedan Advisory Partner with Bain & Company, firstInc. (“Bain”), a global management consulting firm, since July 2010. Ms. Yale was a Partner with Bain from 1987 to July 2010, and was a leader in building Bain’s healthcare practice. In her role at Bain, Ms. Yale works with healthcare payors, providers, and medical device companies, and frequently advises the world’s leading private equity firms on their investments in the healthcare sector. She has served as a consultant, and then as vice president. Mr. Thiry previously served onmember of the board of Varian Medical Systems, Inc. from August 2005 to February 2009directors of several public and private companies in the healthcare sector, and since November 2019 has served as the non-executive chairman of Oxford Health Plans, Inc. until it was sold to UnitedHealth Group in July 2004. As a member of management, Mr. Thiry provides significantthe Board of Directors of Bristol-Myers Squibb Company, a global biopharmaceutical company, and since 2014 has served as a member of the Board of Directors of Blue Cross Blue Shield of Massachusetts ("BCBS MA"). Ms. Yale previously served as Chair of the BCBS MA Board of Directors from 2014 to 2019 and Chair of the Board of Directors of Kindred Healthcare, Inc. from 2010 to 2018. Ms. Yale has a deep knowledge base in the U.S. healthcare sector and has experience in many aspects of the healthcare industry, experienceincluding corporate strategies, marketing and unique expertise regarding the Company's businesscost and operationsquality management, as well as executive leadershipmergers and management experience.

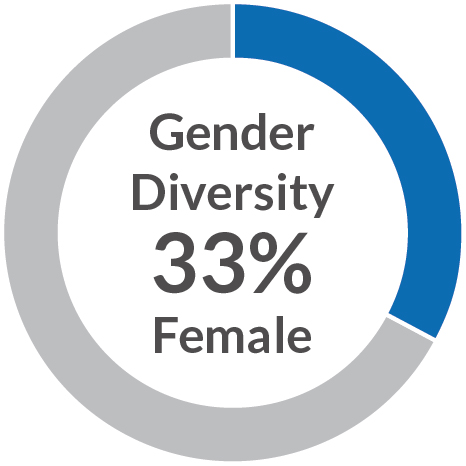

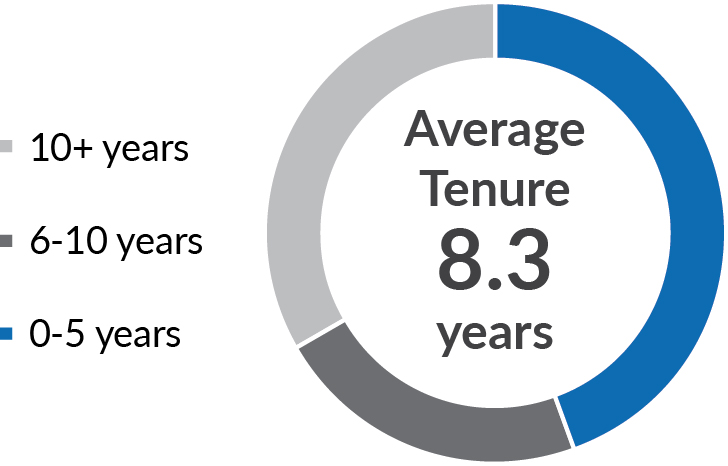

Roger J. Valine, 67, has been one of our directors since June 2006. From January 1992 to his retirement in June 2006, Mr. Valine served as both the president and chief executive officer of Vision Service Plan ("VSP"), the nation's largest provider of eyecare wellness benefits. Upon his retirement, Mr. Valine had worked for VSP for 33 years and provided consulting services to VSP through December 2008. Mr. Valine previously served on the boards of American Specialty Health Incorporated and SureWest Communications. Mr. Valine is an experienced business leader with significant experience in the healthcare industry and brings an understanding of the operational, financial and regulatory aspects of our business as well as extensive management experience.acquisitions.nominees as directors.DaVita HealthCare Partners Inc. Notice of 2016 Annual Meeting and Proxy Statement 9 Corporate Governancegeneral governance framework for the Company is provided by its bylaws,Board believes that a strong corporate governance guidelines, the charters for eachprogram supports long-term stockholder interests. The Board monitors evolving governance standards and regularly seeks stockholder feedback on many of these topics. Some key features of the Board's committees, theCompany’s corporate governance codeprogram include:ü ü ü ü Stockholder right to call special meetings of stockholders at 10% ownership threshold. ü No stockholder rights plan/poison pill. ü ü ü ü Majority vote standard in uncontested elections. ü Robust stock ownership guidelines for senior executives and directors that link the interests of management and the Board with those of stockholders. ü ü ü ethics and corporate codeDaVita shares outstanding as of conduct. These governance documents are available under the CorporateSeptember 30, 2022.Governance section of our website, located athttp://www.davita.com/about/corporate-governance. The22022 Spencer Stuart U.S. Board adopted the corporate governance guidelines to assist the Board and its committees in performing their duties and serving the best interests of the Company and our stockholders.In making recommendation*Under NYSE Independence Standards; as of [_______], 2023 most beneficial to our Company. The committeeNominating and Governance Committee also considers theseeks to ensure an appropriate mix of different tenures of the directors, taking into account the benefits of having longer-tenured directors with longer tenures, includingin providing valuable historical knowledge and greater boardBoard stability and ensuring continuity, of organizational knowledge, andas well as the benefits of having newer directors with shorter tenures,who can provide fresh perspectives and takes steps as may be appropriate to ensure that the Board maintains an openness to new ideasviewpoints. Management and a willingness to re-examine the status quo. In connection with the re-nominationindependent members of current directors, it is the committee's responsibility to determine in each case whether re-nomination is appropriate. The committee assesses each director's performance and contributions to the Board, as well as his or her skills, experience and qualifications, including the continued value to the Company in lightpart of current and future needs, including whether the Company's needs foryear-round engagement program, regularly seek input from stockholders regarding the director's experience and background have changed. If the incumbent director has not performed or contributed in a meaningful way, the committee should consider whether re-nomination isappropriate in light of any other relevant facts and circumstances. Another integral part of this process is the individual director evaluations by the Board members. The Company does not have a specific diversity policy. However, as noted in our corporate governance guidelines, when selecting nominees the committee considers diversityBoard's mix of skills, experience, perspectiveexpertise and background. tenure to further support Board refreshment and the Board's independent oversight of the Company.Independent, Female Board Chair Three Out of Four of Our Current Committee Chairs are Diverse*

nominees for director candidates recommended by stockholders upon submission in writing to our Corporate Secretary of the names and qualifications of such nomineescandidates at the following address, within the timeframe and subject to the other requirements set forth in our bylaws:address: Corporate Secretary, DaVita HealthCare Partners Inc., 2000 16th Street, Denver, Colorado 80202. The committeeNominating and Governance Committee will evaluate candidates based on the same criteria described above, regardless of whether the candidate was recommended by the Company or a stockholder.In March 2016,Nominatingkey skills and Governance Committee recommendedexperience represented by the candidates standing for election atdirector nominees as of [_______], 2023. The details of each director nominee's competencies are included in each director's profile under the 2016 annual meetingsection titled "— Biographies of stockholders.our Director Nominees."Corporate Governance DIRECTOR NOMINEE SKILLS MATRIX SKILLS AND EXPERIENCE Arway Berg Desoer Hollar Moore Nehra Rodriguez Schechter Yale Strategic Initiatives /

M&A☑ ☑ ☑ ☑ ☑ ☑ ☑ ☑ 8 Risk Management ☑ ☑ ☑ ☑ ☑ ☑ ☑ 7 Finance / Capital

Allocation / Accounting☑ ☑ ☑ ☑ ☑ ☑ ☑ 7 Tech / Digital

Transformation /

Cybersecurity☑ ☑ ☑ 3 Gov't / Regulatory /

Public Policy☑ ☑ ☑ ☑ ☑ 5 Public Co. CEO ☑ ☑ ☑ 3 Human Capital

Mgmt / Compensation☑ ☑ ☑ ☑ ☑ ☑ ☑ ☑ 8 Healthcare Provider /

Payor / Investing / VC☑ ☑ ☑ ☑ ☑ ☑ ☑ 7 Public Co. Corporate

Governance☑ ☑ ☑ ☑ ☑ ☑ ☑ ☑ ☑ 9

Annual Board and Committee Evaluations

Rotating cycle with anonymous written evaluations each year and live interviews with each director every other year, which includes individual director evaluations.

Process is overseen by the Nominating and Governance Committee.

Directors provide feedback regarding performance and effectiveness of the Board and its Committees, the Chair and, every other year, individual director performance.

The Board reviews the results of these evaluations in executive session.

The Chair of the Board speaks with each director for one-on-one discussion, as appropriate.

criteria for "independence." No director qualifies as independent under the NYSE listing standards unless the Board affirmatively determines that the director has no material relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company).Independence Standards. In addition, the Company's Corporate Governance Guidelines require that at least two-thirds of the members of the Board has adopted a formal set of standards used to determine director independence. The full text of our directorsatisfy the NYSE Independence Standards and certain additional independence standards is available underdiscussed in detail below and included in the Company's Corporate Governance sectionGuidelines (the "Additional Independence Standards").our website, located athttp://www.davita.com/about/corporate-governance.the Company or one of its wholly-owned subsidiaries or (b) an immediate family member of the director was an executive officer of the Company, (ii) the director, during the current calendar year or any of the three immediately preceding years, has been paid by the Company more than $120,000 in compensation for services, other than for services rendered as a director, or (iii) the director is employed as an executive officer of another public company on whose board of directors any of the Company’s current executive officers serve.has determined that all of the individuals currently serving, or who served at any time during 2015, as members of the Board, other than Mr. Thiry, are independent under the NYSE listing standards and the Company's independence standards. In evaluating each director's independence, the Board consideredevaluates the nature of any executive officer'sofficer’s or director’s personal investment interest in director affiliated director-affiliated

10 Corporate Governance director affiliateddirector-affiliated entities, any special arrangements or relationships between the10Corporate Governancewhichthat would lead to a personal benefit, any personal benefits derived as a result of business relationships with the Company, any other personal benefit derived by any director or executive officer as a result of the disclosed relationships or any other relevant factors.assessing director independence,making its determination, the Board considered investments madeMr. Berg's prior employment with the Company from November 1, 2016 through December 15, 2017, as well as his receipt in 2019 of a one-time cash payment upon the past by some Board members and executive officersclosing of the Company in certain fundssale of a venture capital firmthe Company's DMG business (the "DMG Payment"), both of which Mr. Nehra is a retired special partner or that are managed directly or indirectly by the firm of which Mr. Nehra is a retired special partner. The Board also considered transactions in which WellCare has made payments to us for services rendered in the ordinary course of business in the lastoccurred more than three years which did not exceed the greater of $1 million or 2% of WellCare's consolidated gross revenue in each such year. Mr. Berg was a director and non-executive chairman of WellCare until May 2013 and holds less than a 10% beneficial interest in WellCare.ago. The Board also considered the $465,000Company's commercial relationship with Cigna, where Mr. Berg serves as Senior Advisor. After consideration of additional feesall relevant factors, including, among other things, that the Company's business with Cigna was conducted in the aggregate paidordinary course pursuant to arms length negotiations that did not involve Mr. Berg in his role as a member ofand that the Board's Compliance Committee in 2013 and 2014, in overseeing the 2010 U.S. Attorney physicianCompany's relationship investigation and the 2011 U.S. Attorney physician relationship investigation ("PRI"), at the request ofwith Cigna predated Mr. Berg's employment with Cigna, the Board as well asdetermined that none of Mr. Berg's prior employment with Company, the $59,000 additional fees paid toDMG Payment, or the Company’s commercial relationship with Cigna presented a conflict of interest, nor did they compromise the independence of Mr. Berg in 2015 in his role as the chairman of the Board's Compliance Committee, in overseeing matters related to the subpoenas received by HCP and the five-year Corporate Integrity AgreementBerg.entered into between the Company and the United States Department of Health and Human Services, Office of Inspector General, in connection with the resolution of PRI (the "Corporate Integrity Agreement"). In addition, the Board considered the transactions in which Kindred has made payments to us for services renderedCompany’s commercial relationship with Cardinal, where Mr. Hollar serves as Chief Executive Officer and director, and the Company's commercial relationship with Labcorp, where Mr. Schechter serves as President, Chief Executive Officer and Chairman of the Board. After consideration of all relevant factors, including, among other things, that the Company's business with Cardinal and Labcorp was each conducted in the ordinary course of business in the last three years whichpursuant to arms length negotiations that did not exceedinvolve Messrs. Hollar and Schechter, respectively, and that the greaterCompany's relationship with each of $1 million or 2% of Kindred's consolidated gross revenue in each such year. Mr. Diaz is Kindred's executive vice chairmanCardinal and director,Labcorp predated Messrs. Hollar's and has less than a 10% beneficial interest in Kindred.The Board maintains a policy wherebySchechter's respective consideration for service on the Board, willthe Board determined that the Company’s commercial relationships with each of Cardinal and Labcorp did not present a conflict of interest and did not compromise the respective independence of Messrs. Hollar and Schechter.the director'sa director’s continued service on the Board in the event that the director retires from his or her principal job, changes his or her principal job responsibility or experiences a significant event that could negatively affect his or her service to the Board. In such event, the policy providesCorporate Governance Guidelines provide that the affectedimpacted director shall promptly submittender his or her offer of resignation to the chairmanBoard Chair for consideration by the other members of the Board and the lead independent director.Board. The members of the Board, excluding the affectedimpacted director, will determine whether the affected director'ssuch director’s continued service on the Board is in the best interests of our stockholders and will decide whether or not to accept the resignation of the director. The determination of whether a change in status has occurred is in the sole discretion of the Board. In addition, the policy providesCorporate Governance Guidelines provide that prior to accepting an invitation to serve on the board of directors of another public company or other significant commitments involving affiliation with other for-profit businesses, non-profit entities or governmental units, a director mustshould advise the chairman ofCorporate Secretary or the Board and the lead independent directorChair so that the remaining members of the Board may evaluate any potential conflicts of interest.Mr. Thiry isLeadership Structure and Meetings of Independent DirectorschairmanBoard since May 2009, has served as the independent Board Chair since June 2020. The Board believes that Ms. Arway’s breadth of experience and depth of knowledge gained during her career and her tenure on our Board and the chief executive officer of the Company. Since October 2014, Mr. Thiry has also served as chief executive officer of HCP. Mr. Thiry brings over 15 years of experience with our Company and deep institutional knowledge and experienceare highly beneficial to the combinedBoard Chair role.We believe that Mr. Thiry's experience and knowledgeCEO and chairman are essential to the chairman role and are counterbalanced appropriately by the significant role of the lead independent director. Our lead independent director, Mr. Grauer, who was elected by and from the independent board members, plays a significant role in Board leadership and meetings of the independent directors. Mr. Grauer also chairs our Nominating and Governance Committee, and as chairman of the Nominating and GovernanceCommittee, Mr. Grauer has the authority to call meetings of the committee, whose primary purpose, as outlined in its charter, includes overseeing the evaluation of the Company's management, including the CEO.As lead independent director, Mr. Grauer serves as liaison between the chairmanmanagement and the independent directors approves information sent to the Board, confers with the CEO/chairman in setting and thereafter approvingBoard, approves meeting schedules to assure that there is sufficient time for discussion of all agenda items, and presidesBoard.at which the chairman is not present, including executive sessions of independent directors. Additionally, Mr. Grauer facilitatesrequired, andappropriateContinues on next page ►DaVita HealthCare Partners Inc. Notice of 2016 Annual Meeting and Proxy Statement 11decides when to engage independent advisors for the Board or a Board committee. Mr. Grauer, in his capacity as lead independent director, also has the authority to–May call meetings of the Board and the independent directors and, if requested by major stockholders, makes himselfherself available for consultation and direct communication with them.Independent–Oversees the function of our Board Committees, each of which has an independent Chairmeet regularlyevaluate the Board’s leadership structure, typically on an annual basis.

Succession Planningexecutive sessions without management. Executive sessions are held in conjunctionconsultation with each regularly scheduled meetingthe CEO and that the full Board should have oversight of the Board.succession planning process.Corporate Governance

14 Corporate Governance JULY - SEPTEMBER

OCTOBER - JANUARY MAY - JUNE FEBRUARY - APRIL

Board Diversity Pay-for-Performance Environmental Sustainability Programs and Reporting Board Skills, Tenure and Refreshment and Committee Composition Pay vs. Performance Disclosures Political Spending Disclosures Board Leadership and Succession Planning CEO Compensation and Executive Compensation Program Design Workforce Development and Diversity and Belonging lead independent director, Mr. Grauer,Board Chair may do so by sending an email toleaddirector@davita.com.independentchair@davita.com. In addition, any interested party who desires to contact the Board or any membermember(s) of the Board may do so by writing to: Board of Directors, c/o Corporate Secretary, DaVita HealthCare Partners Inc., 2000 16th16th Street, Denver, Colorado 80202. Copies of any such writtenmember depending on the facts and circumstances described in the communicationmember(s) unless they are considered, in the reasonable judgment of the Corporate Secretary, to be improper for submission to the intended recipient(s).annual meetingAnnual Meeting of stockholders. AtStockholders. Our CEO and director, Mr. Rodriguez, was in attendance at the last annual2022 Annual Meeting of Stockholders, which was held virtually.meeting of stockholders, our chairman and CEO, Mr. Thiry, attended the meeting.committees:standing Committees: the Audit Committee, the Compensation Committee, the Nominating and Governance Committee, the Compliance Committee, the Public PolicyCompensation Committee, and the Clinical PerformanceCompliance and Quality Committee. As required by the NYSE listing standards and U.S. Securities and Exchange Commission ("SEC") rules, all members of the Audit Committee, the Nominating and Governance Committee, and the Compensation Committee are independent in accordance with the NYSE Independence Standards. All members of our Compliance and Quality Committee are also independent in accordance with the NYSE Independence Standards.9 seven times during 2015. Each2022. On average, our incumbent directors attended approximately 99% of all meetings of the Board and Board Committees on which they served, and all of our incumbent directors attended at least 75% of the aggregate of the total number of meetings of the Board and Board Committees on which they served that were held during the total number of meetings held by all committeestime they were a director in 2022.

16 Corporate Governance on which he or she served during 2015.12Corporate Governancechart sets out theforth our current members of our Board Committees and membership, and describes the principalcertain key functions of each committee of our Board. The charter for each committeeof our committees is available underon the Corporate Governance section of our website, located athttp://www.davita.com/about/corporate-governance.Name of Committeeand MembersPrincipal Functions